巴西国家石油公司(PETR3, PETR4)股利分配受到威胁

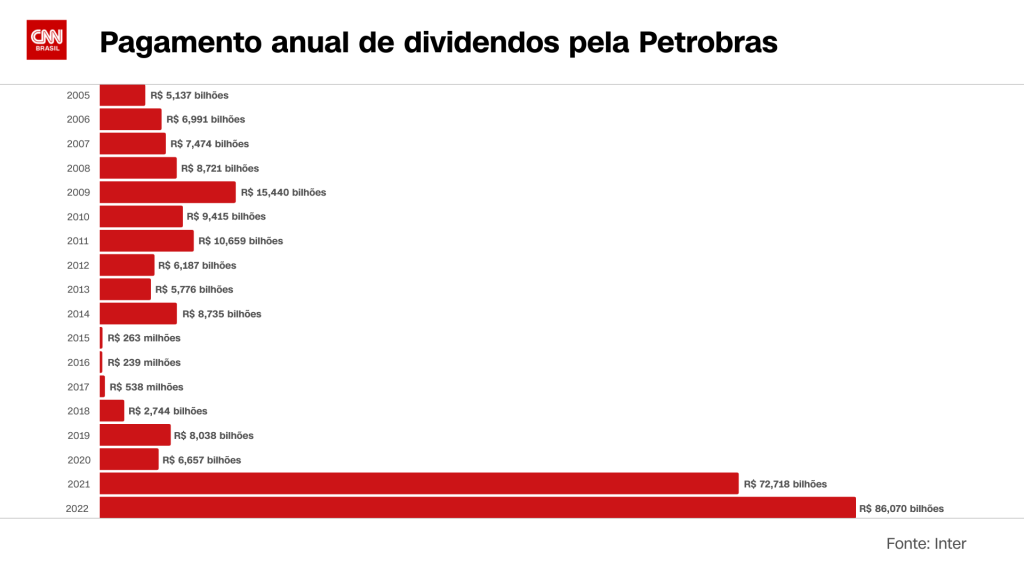

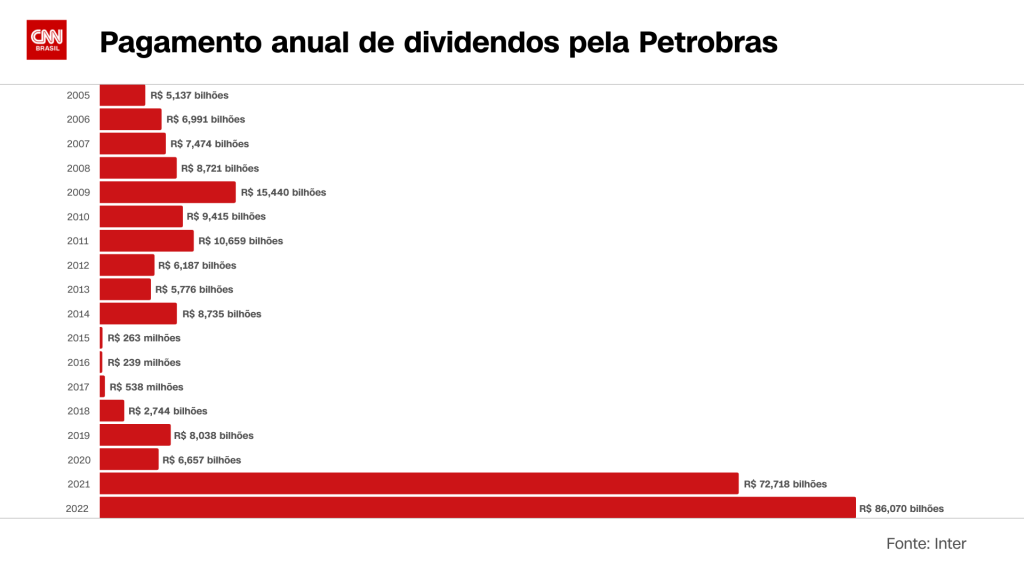

这是在巴西国家石油公司(Petrobras)宣布打算减少今年向股东支付的红利数额后市场的感觉。 起初,这一数字将为350亿雷亚尔,这是一个真正的 "暴跌",如果考虑到去年的分配额,总额为1946亿雷亚尔(在石油上涨之后,除了这一时期的特别支付),此外还有占2021年分配额的一半,即732亿雷亚尔。

在今天(27日)召开的股东大会的 "菜单 "中,主菜当然是很有可能改变(或取消)的分红政策,而由现任总裁让-保罗-普拉特斯提名的石油公司新董事会的任命则退居次要位置。

3月初,公司发布了2022年季度业绩报告,这是公司改变分红政策的最新迹象。 当时,公司董事会提议设立一项应急基金,以 "补偿 "油价的 "任何波动",即防止石油的外部升值立即转移。因此,董事们的想法是从今年宣布的350亿雷亚尔红利中 "提取 "最多50亿雷亚尔。

See_also: 揭秘:如何用一种配料恢复枯萎的玫瑰花据国际经济通讯社彭博社报道,现政府的意图是继续任命此前已通过内部审计的人员进入国有企业董事会。 这一举措将为一劳永逸地结束石油公司现行的红利分配政策做准备。

See_also: 尼古拉斯-凯奇(Nicolas Cage)主演的Netflix网站上有一部当下最令人不安的电影。根据经纪商BBI的评估,如果巴西国家石油公司事实上重视其市场价值,就必须保持 "稳健 "和 "可预测 "的红利流,以此应对与资本分配相关的变化,甚至面对油价波动。

分析师Vicente Falanga和Gustavo Sadka认为,市场上经常出现的问题是,假设2022年第四季度(4Q22)的收益分配获得国有公司新董事会的批准,如何衡量将对巴西国家石油公司股票产生积极影响的派息水平。